A Personal Pension Plan (PPP) is an advanced retirement planning strategy tailored for incorporated professionals—particularly physicians. It combines features of both defined benefit and defined contribution plans, creating a hybrid model that evolves with your career trajectory.

Unlike RRSPs or even IPPs, a PPP offers a more strategic, structured, and flexible path to building long-term wealth. It’s especially beneficial for doctors who have maximized their RRSPs or are seeking smarter, more sustainable ways to allocate retained earnings from their corporation.

The Financial Planning Edge of PPPs for Incorporated Physicians

In today’s evolving financial landscape, PPPs provide physicians with a suite of planning advantages:

Elevated and Adaptable Contribution Limits

PPPs permit significantly higher contributions than RRSPs—and even IPPs—as you grow older. These contributions can include defined benefit elements and Additional Voluntary Contributions (AVCs), which allow you to close the gap on past underfunded years. AVCs must be used in line with pre-established schedules but offer a strategic way to optimize funding using retained earnings.

Corporate Contributions with Personal Impact

Since PPPs are funded by your medical corporation, all contributions are corporately deductible. This structure not only reduces immediate corporate taxes but also fuels long-term wealth planning—aligning today’s financial choices with tomorrow’s freedom.

Investment Autonomy and Scalable Growth

Where IPPs may limit investment options, PPPs are designed with greater flexibility. This allows physicians to align their investment strategy with personal goals, risk tolerance, and evolving market opportunities—maximizing potential growth over time.

Asset Security and Risk Management

PPP assets are shielded from creditors, adding a protective layer for physicians concerned with litigation or financial exposure—especially relevant for those in high-liability specialties.

Layered Wealth-Building Strategy

PPPs offer a multi-channel approach to retirement funding, including terminal funding opportunities and catch-up mechanisms. This layered structure supports physicians through different life and career stages, allowing for increased financial precision.

RRSPs, IPPs, or PPPs? Choose Strategic Financial Planning

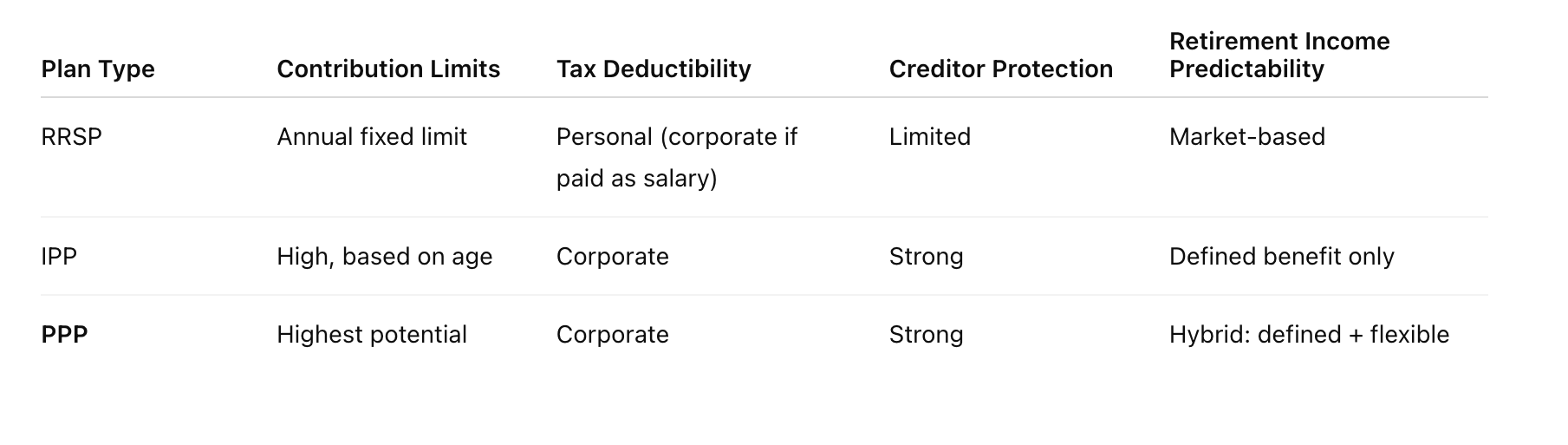

While RRSPs and IPPs can serve foundational roles, a PPP often emerges as the most sophisticated solution for high-earning, incorporated physicians:

Is a PPP Right for You?

You may benefit from a PPP if you:

-

Are over 40 and earning substantial income through your medical corporation

-

Want to contribute beyond traditional RRSP and IPP limits

-

Prefer a hybrid structure that merges stability with investment flexibility

-

Seek to maximize corporate financial efficiency while building personal wealth

-

Require strong asset protection within your retirement portfolio

How ILM Supports Your PPP Journey

At Imperial Lifestyle Management, we offer bespoke financial planning solutions for physicians and medical professionals. A PPP is one tool within our broader strategy to help clients build resilient, tax-smart wealth structures.

Strategic Assessment

We review your financial and corporate profile to determine how a PPP integrates into your comprehensive financial plan—not just from a tax perspective but as part of a long-term lifestyle strategy.

Expert Coordination

While we do not directly manage actuarial responsibilities, we work alongside trusted partners and actuaries to help coordinate the setup and administration of your plan seamlessly.

Continuous Optimization

As your income and financial goals evolve, so does your PPP. ILM monitors performance, legislative changes, and life events to ensure the plan continues to align with your future objectives.

Plan Your Wealth With Precision

You’ve devoted your life to helping others. Now it’s time to take care of your future with a solution designed to reward your success and safeguard your lifestyle.

Book a consultation with Imperial Lifestyle Management today.

Let’s design a retirement strategy that reflects your ambition, your career, and your values.

Stay In Touch