Making Intelligent Decisions With Imperial Lifestyle Management

We endeavor to be the one-stop solution to your financial planning and management needs.

We take the stress off our clients by allowing them to be medical experts, not financial experts. Our integrated approach closes the gaps since we take care of the details and empower you to make intelligent financial decisions.

Our group specializes in working with new physicians within 5 years of residency or fellowship to help set up and minimize the financial aspects of their practice.

Top 1% of Canadians earns $381,300*

As a part of this elite group Imperial’s services have been specifically tailored for you!

Providing You With The Best Solutions

“I wear too many hats throughout the day”

“there is never enough time in the day to get it all done.”

“ called the bank bounced around from 1 person to the next!”

“I am not good at managing my finances”

“will I ever have work-life balance?”

“my accountant doesn’t give me advice”

“I am worried about having enough to retire and being taxed to death

in the process”

“I need help setting up my practice ”

“my team doesn’t communicate with me”

“The CRA called me today – you deal with it!”

-

TRUST

-

HIGH

-

QUALITY

-

VISIONARY

-

INNOVATIVE

-

POWERFUL

-

EXCELLENCE

-

EXCITING

-

INTEGRITY

Providing You With The Best Solutions

“I wear too many hats throughout the day”

“there is never enough time in the day to get it all done.”

“ called the bank bounced around from 1 person to the next!”

“I am not good at managing my finances”

“will I ever have work-life balance?”

“my accountant doesn’t give me advice”

“I am worried about having enough to retire and being taxed to death

in the process”

“I need help setting up my practice ”

“my team doesn’t communicate with me”

“The CRA called me today – you deal with it!”

-

TRUST

-

HIGH

-

QUALITY

-

VISIONARY

-

INNOVATIVE

-

POWERFUL

-

EXCELLENCE

-

EXCITING

-

INTEGRITY

You Are The Core of What We Do!

Be Proactive

Outside of your mortgage, your tax bill is likely the largest monthly drain on your cash flow. As part of our CFO program, your team will review your banking activity on a monthly basis and make recommendations accordingly to reduce your tax exposure

Listen

We actively listen to you as we build our working relationship, get to know what makes you tick. Data comes in all shapes and sizes, which is why

we review everything to ensure we missed nothing.

Remove Stress

At Imperial, we understand the great importance of proper planning. After combing through all the data collected, we meet as a team to ensure all aspects of your plan are accounted for.

Communicate

Many of us spend far too much time with our heads down and we can’t see forest though the trees. At Imperial, we see the big picture. With your permission, we contact your advisors, lawyers, bankers, accountants to make sure everyone is on the same page.

Manage The Plan

No matter how much information we collect there will always be changes along the way, new babies, houses, cars, etc. Your team will be there to guide you through the process.

Use Debt Effectively

Debt isn’t always a bad word, when used effectively it can help anyone achieve their goals It’s not for everyone, which is why we only recommend solutions involving debt to you if it fits in your plan.

Sound Advice

Knowing the lifestyle you desire in retirement, your team is able to allocate your capital in a way that will keep your goals at the forefront.

Our results

93% of the new families we work with are referred by existing clients.

86% of our clients serve as references, attesting to our ability to deliver powerful results.

93% Client retention since inception in 2011.

WE MAKE IT HAPPEN

Experience the peace of mind in knowing your affairs are being handled by the very best industry experts.

Client of Today

- Recognizes time is an expensive commodity a Income of $250k +

- Medical Professionals

- Decision Makers

- Potential to be incorporated

- Sophisticated traditional investor

- Seeks advice from trusted professionals a Lifestyle focus

- Goal oriented with long-term views a Education is a premium and especially important for their children

- High value on health and wellness a Respected and trusted professionals a Value advice/relationships

- Open-minded, balanced

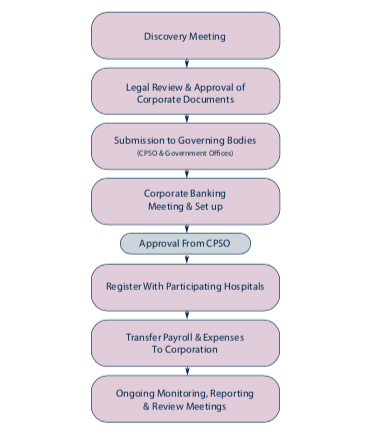

Our Incorporation Process

Just Starting Out

Our team provides the depth of expertise and breadth of resources to meet the exclusive needs of our professional clients. Our proven process offers both discipline and flexibility to deliver results-oriented financial solutions all within a simplified process.

Our Process Includes

- Search & Reserve Corporate Name

- Preparation of Incorporation Documents

- Filing of Incorporation Documents with Governing Bodies a Corporate Minute Book

- Corporate Share Certificates

- Corporate Organization

- Personalized By-laws & Organizational Resolutions

- Personalized Registers & Ledgers

- Corporate Seal

- Client Confidentiality & Canadian Privacy Protection

Value Added Services We Provide:

- Contact all hospitals you are accredited with to ensure all future income is paid to your corp

- Meet with your banker to set up corporate accounts

- Review your expenses which corporation can pay

- Tax advice for more efficient results

- Corporate tax return completed by our team at half price for the first year

- Phone/Text & Email Support

Your Single Point of Contact

Your Single Point of Contact

Imperial Quarterly Meeting Breakdown

Q1: January

Net Worth Planning

- Collect and review Personal and Corporate Information

- Personal Information Review

- RRSP Top Ups

- Review Current Year Goals and Objectives

- Lifestyle Performance Review

Q2: April

Tax Planning

- Collect and review Personal and Corporate Information

- Personal Information Review

- Review Current Year Goals

- Preliminary Tax Plan Review

- Lifestyle Performance Review

Q3: July

Cash Flow Plan

- Collect and review Personal and Corporate Information

- Personal Information Review

- Review and set expense Goals

- Review Overall Plan Objectives

- Cash Flow Assessment

- Lifestyle Performance Review

Q4: October

Strategic Planning and Review

- Collect and review Personal and Corporate Information

- Personal Information Review

- Set Financial Planning Goals for Next Year

- Imperial Retirement Report

- Lifestyle Performance Review

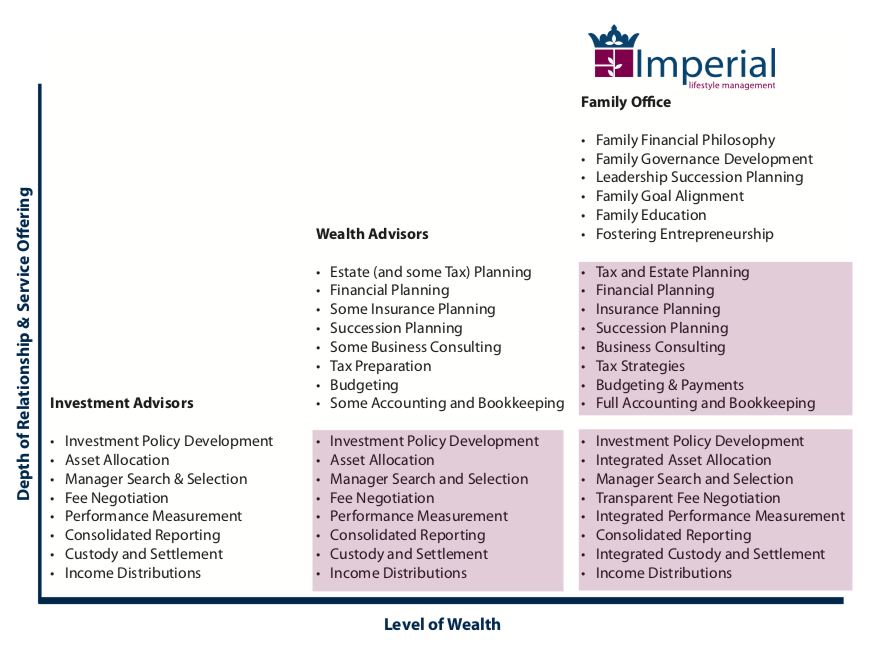

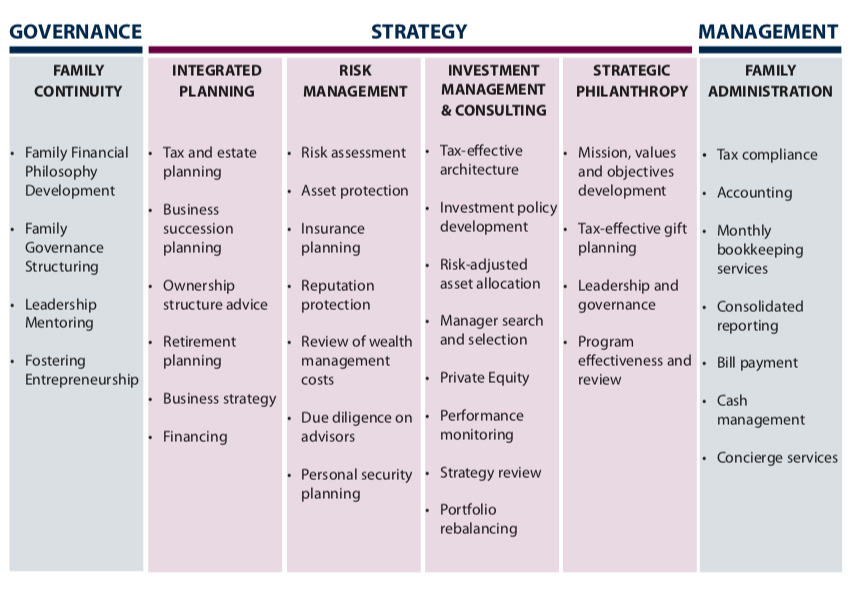

What is a Family Office?

A family office is a professional services practice dedicated to managing the personal wealth of affluent individuals and families.

A family office serves as a chief financial officer and advisor for affluent individuals and families, providing highly integrated, inter-disciplinary services in the advice and management of the financial affairs of their clients.

The Imperial Family Office Difference

Imperial’s family office offer a wide array of financial and wealth management disciplines to meet the needs of our clients. Family offices must be intimately familiar with the demands of the client and be able to provide skills and capabilities, instead of just products and services, to creatively respond to the needs of family office clients.

Service levels are custom-designed and integrated among disciplines to deliver specialization where needed with greater attention to detail and confidentiality not available from larger product-driven financial institutions and other “wealth advisors.”

We Have Our Clients Solutions

Andrew and his team have been an invaluable asset to my business, and I cannot recommend them highly enough. They have provided me with the most thoughtful, helpful and comprehensive advice around managing my business, investments, and financial planning. I recently moved across the country and there was no doubt I would remain a client: it is rare to find such talent, accountability and accessibility in a team. They have my highest endorsement …. Dr C. Kim, Vancouver

Andrew is very professional and thoughtful. He always demonstrates a standard of character that I am pleased to experience and pleased to share with others. His communication style, efficiency and knowledge are a rare find. Thank you Andrew for taking care of me and Sheila … Warren Trimble, Hamilton

We truly enjoy working with our team at Imperial as the benefits they offer us are tremendous. I know they’re just a phone/email away and always get back to us on the same day. They have helped us to manage our life. It really has made a big difference in our lives. We continue to sing your praises… Dr. Sehdev and Dr. Venantius, Ancaster

Imperial allows me to focus on the things I want to do and provides support in the things I have to get done. I can always rely on Andrew to have my concerns and requests quickly addressed. I also can rest easy knowing that they have gone out of their way to ensure my best interests are looked after. Whether its providing me advice on my investments or finding the best possible price for a hotel booking. They have saved me a lot of time, money and stress … Dr. Valani, Hamilton

I always introduced Andrew as the guy who manages my life. Thank you man for always picking up my calls and helping me set-up my practice. I don’t know what I would do without you … Dr. Price, Hamilton

During the last 6 years, Imperial Lifestyle Management has specialized in working with young doctors by helping them to set up, and manage the financial aspects of their growing medical practices. With their team of accountants, lawyers, financial and investment professionals, they provide the opportunity to review all aspects of your financial situation at one time to ensure cohesive and actionable recommendations … Ryan Wiley, Burlington

FINANCIAL • WEALTH • DECISIONS

Whatever your aims, the advisors at Imperial Wealth Management will help you achieve your goals with the right products and services by tailoring plans designed to fit your budget and objectives. We always welcome new clients with a one on one meeting to determine short and long term goals, starting with a five year plan and moving forward.

Our process is geared towards ensuring our clients have a clear and focused understanding of how their money is working for them and the choices they have. We give clients our time. Time to create a secure financial future based on our guaranteed insurance products and services.

Stay In Touch