At its essence, the Scientific Research and Experimental Development (SR&ED) initiative is geared towards motivating businesses, including healthcare practices, to engage in research and development (R&D) activities that pave the way for innovative, enhanced, or technologically superior products or procedures. For the healthcare sector, this means backing for exploratory development focused on advancing medical treatments, diagnostic methods, and patient care approaches. Medical professionals should be aware that SR&ED claims can be made for R&D activities carried out in past years, providing a chance to capitalize on previous investments in innovation.

Eligibility Requirements: Deciphering SR&ED for Healthcare Professionals

To qualify for the SR&ED program, your project needs to fulfill certain conditions, including achieving a scientific or technological breakthrough, encountering technological uncertainties, and performing systematic exploration. The Canada Revenue Agency (CRA) defines a ‘systematic exploration’ as a focused and methodical effort, comprising a hypothesis and experimental or analytical operations aimed at realizing scientific or technological progress. These principles are crucial to the SR&ED scheme, ensuring that efforts contribute to meaningful and groundbreaking research pursuits.

Qualified activities cover a wide range, from clinical investigations to the creation of novel surgical tools and methods. However, to precisely assess your project’s eligibility, consider the following crucial inquiries:

Is Your Practice Incorporated?

Significance: The legal structure of your healthcare practice plays a vital role in determining your potential for SR&ED claims. Canadian Controlled Private Corporations (CCPCs) benefit from favorable tax advantages, including increased refundable credits, which aren’t accessible to sole proprietors or partnerships. Forming a corporation can safeguard personal assets from liabilities and offers a tax-efficient framework for reinvesting in research and development. Notably, a corporation can get a refund up to 35% of eligible expenses, while an individual practitioner operating solo may receive a tax credit of 15%, highlighting the financial merits of incorporation.

Actionable Advice: If your practice is not yet a legal entity, engage with a financial consultant to explore the possible SR&ED and other tax advantages of becoming incorporated. If you’re already incorporated, make sure your corporate structure is fully optimized for SR&ED benefits.

Do You Have a Medical Specialty?

Significance: Medical specializations often lead the way in technological and innovative advancements, positioning them as ideal candidates for SR&ED tax benefits. Specialized research, whether in oncology, cardiology, or another area, can significantly enhance patient care and medical technologies.

Actionable Advice: Document the distinctive features of your specialty contributing to technological progress. Prepare case studies or summaries showcasing innovative elements of your practice, to support your SR&ED claim.

Do You Undertake Research?

Significance: The SR&ED scheme supports a diverse array of research activities. Whether your investigation aims at uncovering new insights or applying existing knowledge in novel ways, it’s crucial to recognize how your work aligns with the SR&ED framework.

Actionable Advice: Maintain thorough records of your research endeavors, including experimental layouts, data gathering methods, and analysis. This not only aids in formulating a strong SR&ED claim but also contributes to the advancement of your field.

Is Your Research Published?

Significance: Publishing your findings serves as a concrete indicator of your contribution to the scientific domain. Publications provide proof of peer acknowledgment and support the advancement of knowledge — a fundamental requirement for SR&ED eligibility.

Actionable Advice: Strive to disseminate your discoveries through esteemed journals and conferences. Compile a portfolio of your publications, including any peer evaluations, as part of your SR&ED claim documentation.

Do You Document Your Research?

Significance: Thorough documentation is the cornerstone of any SR&ED claim. It verifies your research activities, backs up claims of technological progress, and illustrates your systematic approach to solving scientific or technological challenges.

Actionable Advice: Develop an exhaustive documentation strategy from the onset of your research initiatives. This should encompass project outlines, hypotheses, experimental setups, data, analyses, and conclusions. Consider employing digital platforms for project management and record-keeping to simplify this procedure.

Maximizing Your SR&ED Claim: Strategic Insights

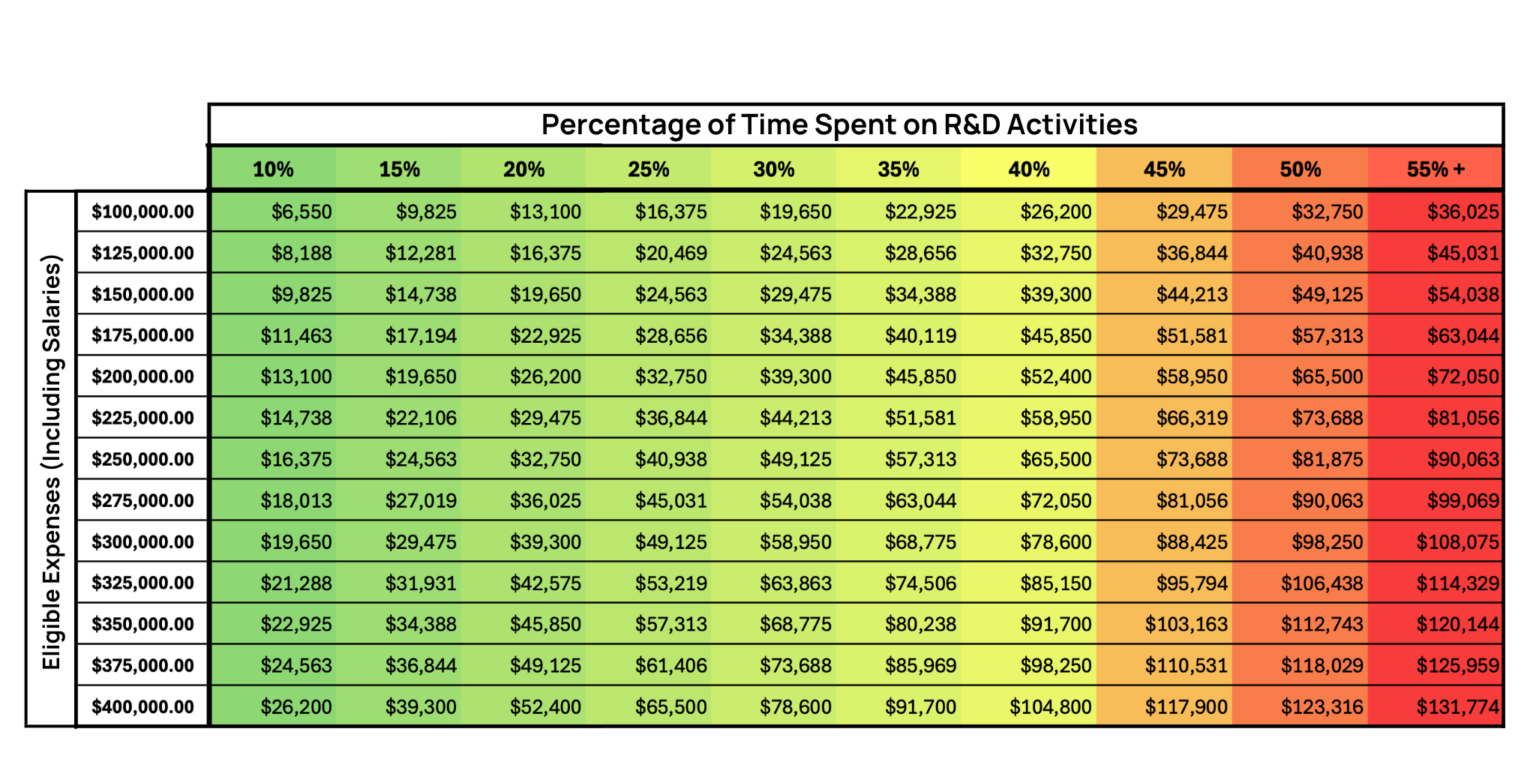

Securing SR&ED success extends beyond merely conducting eligible R&D. Strategic foresight, prompt identification of projects, and thorough documentation are pivotal. To grasp the potential financial advantages better, refer to the included salary chart that approximates the SR&ED tax credits and refunds based on various levels of R&D spending and salaries. This resource is intended to help healthcare professionals visualize the substantial effect that dedicated research time can have on maximizing SR&ED benefits.

Imperial Lifestyle: Your SR&ED Navigator for Healthcare Innovation

At Imperial Lifestyle, we specialize in guiding through the SR&ED landscape, meticulously designed for the healthcare sector. We aid in distinguishing R&D activities that qualify and evaluate their impact on your fiscal strategies. Our ensemble of SR&ED experts is committed to assisting you in creating detailed documentation and enhancing your tax incentive claims. With our unwavering support, your innovative pursuits are recognized and rewarded, propelling further advancements in medical research and innovation.

Elevating Healthcare Innovation via SR&ED

The SR&ED initiative acts as an essential support mechanism for Canada’s healthcare innovators, offering financial backing to foster the creation of revolutionary improvements in patient care. By comprehending the detailed eligibility criteria and engaging in strategic planning and documentation, you can ensure that your SR&ED claims effectively support your ongoing contributions to medical science. Engage with Imperial Lifestyle for thorough advice and backing on your SR&ED journey.

Schedule a Consultation with Imperial Lifestyle

Explore the benefits SR&ED can bring to your medical research and practice. Reach out to us for a consultation to review your eligibility and discuss how to augment your R&D efforts with SR&ED tax incentives, ensuring your innovative work receives the recognition and compensation it deserves.

Kindly note, the processing timelines for SR&ED claims by the CRA typically range up to 60 days, with an additional period extending up to 180 days for issuing refunds or credits. These intervals are crucial for strategically managing your practice’s financial planning and cash flow.

Stay In Touch